Imagine that you unexpectedly receive payment claims of hundreds of thousands of kronor from a bank that you’ve never been a customer of. You’ve become a victim of one of the newest forms of crime – identity theft – where the perpetrator is pretending to be you.

Today, ID theft is one of the most common types of fraud in Sweden. According to statistics, there is a victim of ID theft every three minutes. People with a stable income and no records of unpaid debts are usually targeted. Ironically, if you have a good credit score, it´s bad news in this context.

One can never be completely protected against ID theft. There are, however, several ways to reduce the risk of being exposed. Here are 8 concrete tips:

1. Protect your account information

Sending your account information via email, SMS or social media is never a good idea. Keep an eye on your debit cards. Never give your codes to anyone else, and avoid writing them down on notes that can easily get lost. Authorities and banks never ask for account or card details, such requests are guaranteed to be a scam.

2. Follow up on unexplained credit information

If you receive a letter with the letter stating that a company has requested a credit report on you but you do not know why, then it may be a sign that someone else wants to trade on credit or take a loan in your name.

3. Keep track of your account

To check that there are no unexplained transactions in your account, you should check your bank statements regularly. Many banks also have apps that allow you to easily monitor what is happening in your account.

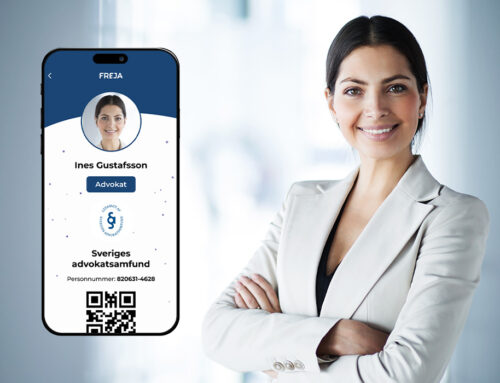

4. Get a free ID protection

By downloading Freja eID Plus, you get a free ID protection that warns when someone changes your residential or special postal address. This is often the first sign of identity theft.

Freja eID Plus does not inform about change of address or forwarding of mail made via Svensk Adressändring, which is a private service from Postnord and Citymail, so you should also activate the address lock at Swedish Address Change for better protection.

5. Lock your mailbox

Fraudsters can order a new bank card in your name, which they then pick up from your mailbox. Of course, you can break into the mailbox despite locks, but a broken mailbox is a kind of warning in itself.

6. Protect your devices

Fraudsters use virus and spyware to steal your identity. Make sure that you’ve updated security solutions for your devices, all devices that use wi-fi are likely to be vulnerable. Credit card numbers, e-mails, passwords and photos are sensitive information that should be kept in secure storage. Use login to your mobile devices and set a short time to activate the screen lock.

7. Garbage with sensitive information is gold for the fraudster

Letters and papers containing personal information, such as social security numbers or account numbers, should never be thrown in the garbage or in the paper recycling unless you first tear the paper properly or mask the private information.

8. Block your debit card

Reduce the fraudster’s ability to use your card details by blocking your debit card for use on the Internet or abroad. Only unlock it when you need to use it, this service is offered by many banks. You can also get an extra credit card that you use when shopping online or shopping abroad.