That is actually one of the most common questions we get. Other ones are ‘Which one should I choose?’ or ‘Can I have both?’. Here we’ve got the answers!

For many years Sweden was completely reliant on just one e-ID, BankID. Over time, as more and more people started using e-IDs, government initiatives encouraged more options in this field which yielded Freja.

Freja was launched on 17 August 2017 and is one of Sweden’s fastest growing digital services with almost 800,000 users.

Greatly Similar in Certain Regards

So what is the difference? Let’s start with the similarities. Both Freja and BankID are e-IDs that meet the high requirements needed for the Swedish government’s quality mark ‘Svensk e-legitimation’. Essentially this means that both Freja and BankID have the security and trust required to be used for public services and for payment transactions.

Both Freja and BankID can be used to log in to e-services and for making legally binding electronic signatures, and both are available as mobile e-IDs.

Both Freja and BankID are owned by private companies and neither of them are actually public or government e-IDs. They are both, however, government-approved which contributes to the perception that they are owned by the state.

Different Coverage and Conditions of Use

Where Freja and BankID differ are the conditions for use and their coverage. BankID currently operates with more e-services than Freja. Approximately 5000 e-services are connected to BankID compared to approximately 500 for Freja.

However, Freja’s digital ID card can be used as proof of identity at approximately 7000 locations across Sweden for picking up packages, prescription medicine, earning loyalty points and buying age-restricted products. BankID does not have a digital ID card like Freja, but can replace a physical ID document in certain contexts e.g. when picking up a parcel.

Freja and Bank ID also differ slightly when it comes to who can get them. BankID is issued by bank so the prerequisite is that you must have a bank account in order to have BankID. As there are many rules around who can have a bank account that banks must comply with, people who do not fulfil these rules cannot have a bank account and, by extension, cannot be issued a BankID.

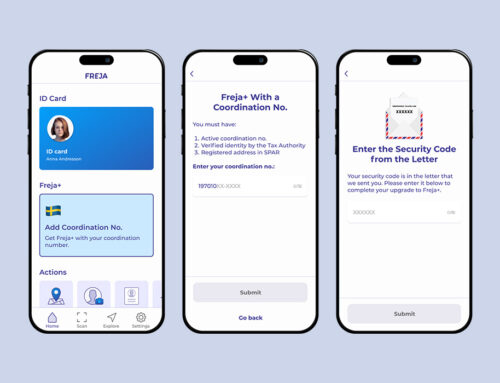

Freja is an e-ID that is independent of the banks. Therefore, it can be issued to people that don’t have a bank account/do not meet the banks’ criteria.

Freja is completely free to use. BankID, while free to use, is a service provided by the bank on the basis of having a bank account which does include fees.

Various Features

Freja is solely mobile-based, whereas BankID can be used with a card in conjunction with a reader connected to a computer, in addition to the BankID mobile application.

In addition to the electronic identification (login) and signing offered by both services, Freja also includes the following features:

- a digital ID card in your phone – when you receive a package, want to pick up prescription medicine, earn loyalty points and in stores in general for proving your age;

- a service/organisation ID – Freja OrgID which separates employees’ private and work e-IDs; issued by your employer/company;

- a free ID protection – if someone unauthorised tries to change your officially registered address;

- the Shared Control feature – two people may link their Freja accounts so that one is assisting the other to use Freja e.g. a family member or a caregiver;

- a digital wallet – where you can store your Covid Certificate for example;

- Explore – Discover and safely interact with different services directly through Freja.

Should You Have Freja or BankID?

If you have the opportunity, it is a great idea to have both. If you’ve read this far, you know that there are some differences in the features and use cases between Freja and BankID. This means that they can solve different problems for you.

If you only use services that accept both solution, such as the Swedish Tax Agency, it is still a good idea to have both just in case, as part of your digital preparedness. Think of it as the same as having both a Mastercard and Visa when travelling abroad.

The answer to the question whether you can have both Freja and BankID is – yes. There is no logical reason why you would be prohibited from having both the Freja and BankID apps on your phone. You only need to meet the requirements of the respective issuers. If you do, you can use both in whichever situation that you wish.

Do you have more questions about Freja? Check out our Frequently Asked Questions.

Our customer support is here for you daily between 08-22. Call us on +46 8 38 88 58 or send us an email at support@frejaeid.com.