We’ve prepared some valuable tips and important date reminders for you! There are quite a few tax deductions that you may be entitled to but that are easy to miss.

Rental of housing

You can rent out your private residence tax-free for rental income of up to SEK 40,000 per year. The surplus of the rental is taxed as capital income at 30 percent. There are different rules if you rent out a detached house, condominium or rental property. You may not make any deductions for increased operating costs or renovation.

ROT & RUT

You can get a tax reduction for labor costs for household-related services (RUT) of SEK 75,000 per year, while the root deduction (labor costs for repair, maintenance and renovation and extension) is a maximum of SEK 50,000 per person per year. The combined ROT and RUT deduction may be a maximum of SEK 75,000 per year.

Deduction for green technology

A novelty from this year is that you can get a tax deduction if you have installed green technology e.g. solar panels on your roof. You can get a tax reduction of up to SEK 50,000 per year. It applies to installations that have been started, paid for and completed no earlier than January 1, 2021

Purchase and sale of securities

If you save in an investment savings account (ISK), the tax is based on a standard income. This information, which is an assumed annual return, is already pre-filled in your declaration. So you don’t have to do anything about it. The tax you must pay is 30 percent of the standard income.

However, if you transfer securities from a depository to an ISK, the transfer is considered a disposal, sale. You therefore need to report the sale as a capital gain or capital loss in your return. If you have sold securities at a profit and in the same year sold securities at a loss, you can set off the closings against the profit.

The tax on excess capital is 30 percent. You get a 30 percent tax reduction on capital deficit if the deficit is a maximum of SEK 100,000. If the deficit is greater than SEK 100,000, the tax reduction is 30 percent of SEK 100,000, that is, SEK 30,000 plus 21 percent of the part of the deficit that exceeds SEK 100,000.

Travel to work

If you spend at least 2 hours per working day by taking a car instead of going to work with the municipality, you may make a deduction. You need to have at least 5 kilometers between your home and your workplace to be entitled to the deduction.

Important Dates to Remember

- 15 March – now you can declare your taxes. With Freja+, you can log in to the e-service ‘Inkomstdeklaration 1’.

- 30 March – the last day to approve your return digitally, without changes, to receive the tax refund in April.

- 2-3 April – Skatteverket sends you a final tax notice that approves your return digitally without changes by March 30 at the latest. If you do not have a digital mailbox, you will receive the final tax notice by mail 1-3 weeks later.

- 2 May – the last day to declare your taxes if you have not been granted an extension of time to submit the declaration.

- 4–5 June – Skatteverket sends you a final tax notice who declared no later than 2 May and whose declaration has been approved. If you do not have a digital mailbox, you will receive the final tax notice by mail 1-3 weeks later.

- 8–9 June – Skatteverket pays out the tax refund to people who declared no later than 2 May and whose declaration has been approved.

- 12 September – the last day for payment for most people with back taxes. You must pay the tax within 90 days of receiving your final tax statement. The date is in the final tax notice.

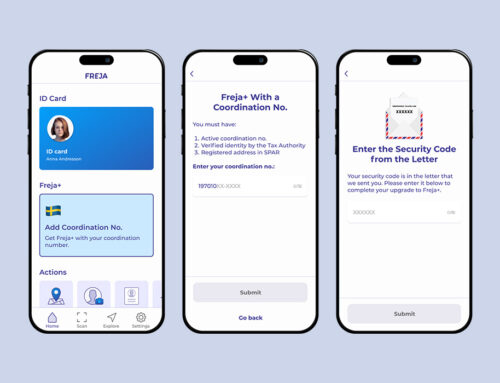

Don’t Have Freja+ Yet?

No worries – you just need to confirm your identity with an ID document in the Freja app.

After that you need go to your nearest Freja agent (there is a map in the app), bring your mobile phone and the ID document you used when registering. The physical meeting only takes place once and is a requirement from the authorities. For security reasons, it takes about 3 hours for the upgrade of your Freja+ to be registered. You will receive a notification when it is ready.

More questions about Freja? Support is available from 08:00 to 22:00, every day of the week. Call +46 8 38 88 58 or email support@frejaeid.com.